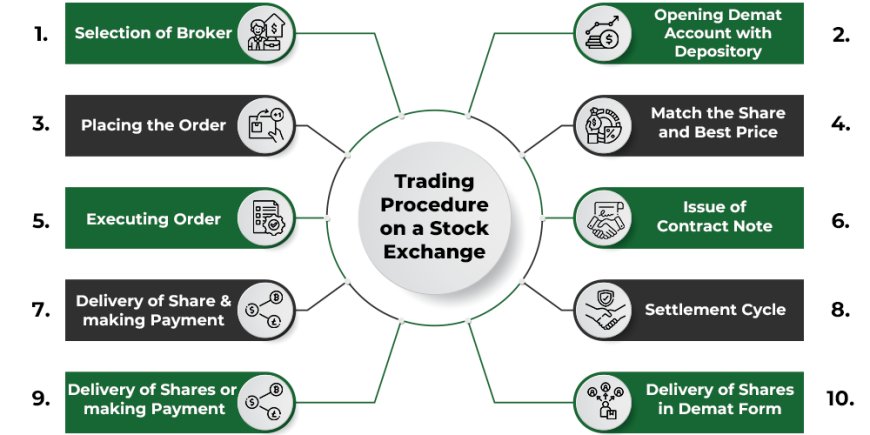

what is trading mechanism how to work it step by step.

The trading mechanism refers to the processes and rules that govern the buying and selling of financial instruments in a stock market. It outlines how orders are placed, matched, and executed. The specific details of the trading mechanism can vary between different stock exchanges, but here is a generalized step-by-step explanation of how trading typically works:

1. Opening Accounts:

- Individuals who wish to trade in the stock market first need to open a Trading Account and a Demat Account with a registered stockbroker.

2. Placing Orders:

- Investors use their Trading Accounts to place buy or sell orders. Orders can be market orders (executed at the current market price) or limit orders (set at a specific price).

3. Order Routing:

- The stockbroker receives the order and routes it to the stock exchange. This can be done electronically through online trading platforms.

4. Order Matching:

- On the stock exchange, buy orders are matched with sell orders based on price and time priority. The order book maintains a record of all open buy and sell orders.

5. Trade Execution:

- When a buy order is matched with a corresponding sell order, a trade is executed. The stock exchange confirms the transaction, and the trade details are sent back to the broker.

6. Trade Confirmation:

- The broker notifies the investor of the executed trade. This confirmation includes details like the price, quantity, and time of the trade.

7. Clearing and Settlement:

- The trade moves to the clearing and settlement phase. The stock exchange's clearinghouse ensures that the buyer receives the securities, and the seller receives the funds. This process typically follows a T+2 (Transaction date plus two business days) settlement cycle.

8. Dematerialization and Crediting:

- In the case of securities, the sold shares are debited from the seller's Demat Account, and the bought shares are credited to the buyer's Demat Account.

9. Funds Transfer:

- In the case of funds, the money is transferred from the buyer's trading account to the seller's trading account.

10. Account Updates:

- The broker updates the investor's Trading and Demat accounts with the executed trade details. Investors can access these details through their online trading accounts.

11. Market Surveillance:

- Throughout the trading day, the stock exchange conducts market surveillance to detect irregularities, monitor price movements, and ensure fair and transparent trading.

Important Points to Consider:

-

Trading Hours: Stock exchanges have specific trading hours, and orders can only be placed during these times.

-

Circuit Breakers: Stock exchanges may implement circuit breakers to temporarily halt trading in the event of significant market movements.

-

Regulatory Oversight: Trading activities are regulated by government authorities or independent regulatory bodies (e.g., SEC in the United States, SEBI in India) to ensure fair and transparent practices.

-

Brokerage Charges: Investors may incur brokerage fees and other charges for executing trades. These fees vary among brokers.

-

Risk Management: Investors often use risk management tools such as stop-loss orders to limit potential losses in case the market moves against their positions.

What's Your Reaction?